Business Insurance in and around Council Bluffs

Searching for coverage for your business? Look no further than State Farm agent Tracy Hough!

Helping insure small businesses since 1935

- Council Bluffs

- Omaha

- Bellevue

- Treynor

- Carson

- Carter Lake

- McClelland

- Minden

- Underwood

- Neola

- Walnut

- Oakland

- Macedonia

- Crescent

- Avoca

- Papillion

- LaVista

Insure The Business You've Built.

When experiencing the wins and losses of small business ownership, let State Farm do what they do well and help provide excellent insurance for your business. Your policy can include options such as a surety or fidelity bond, extra liability coverage, and errors and omissions liability.

Searching for coverage for your business? Look no further than State Farm agent Tracy Hough!

Helping insure small businesses since 1935

Keep Your Business Secure

When you've put so much personal interest in a small business like yours, whether it's a toy store, an appliance store, or a barber shop, having the right protection for you is important. As a business owner, as well, State Farm agent Tracy Hough understands and is happy to offer exceptional service to fit the needs of you and your business.

Get right down to business by contacting agent Tracy Hough's team to review your options.

Simple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

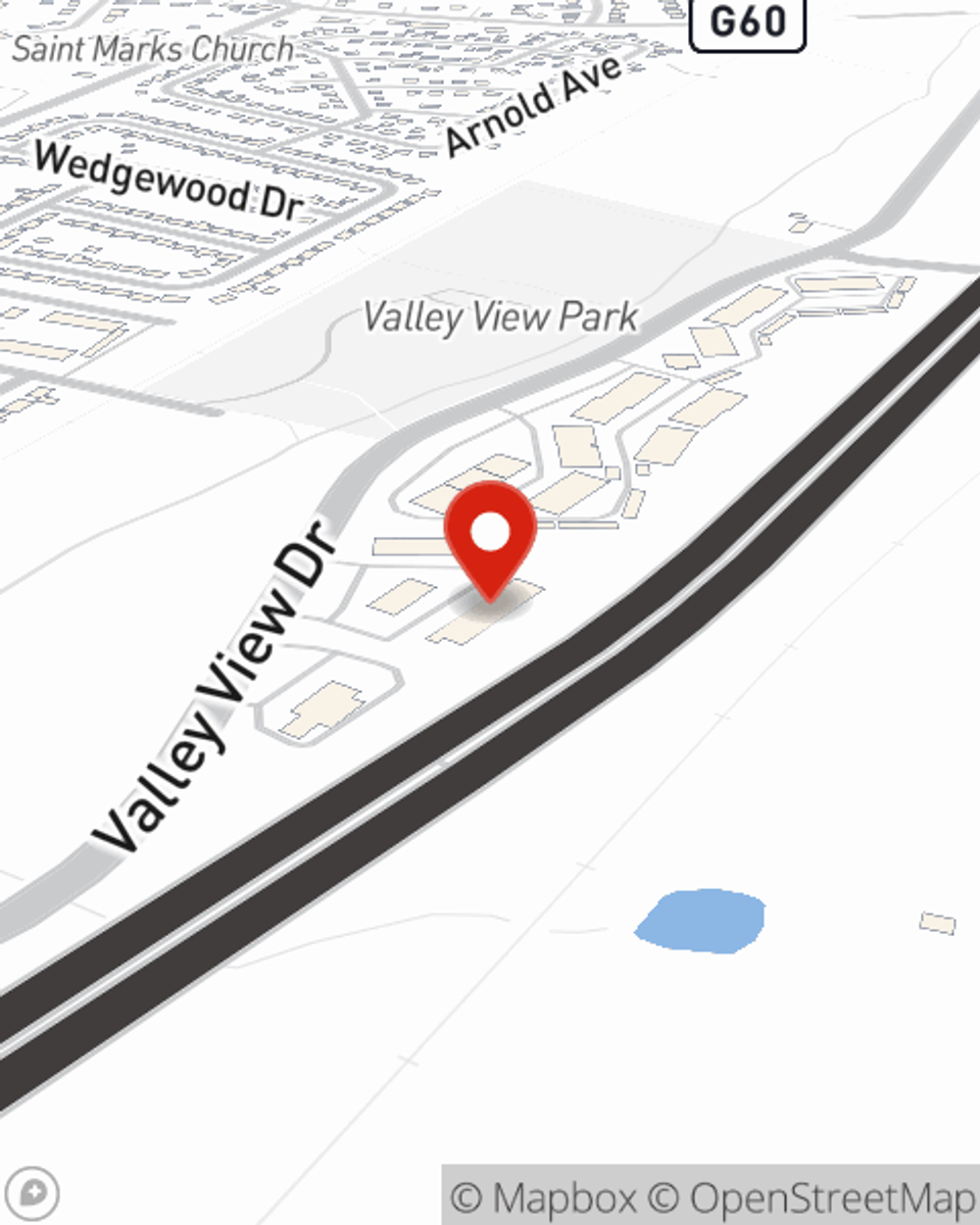

Tracy Hough

State Farm® Insurance AgentSimple Insights®

Trailer insurance coverage

Trailer insurance coverage

Consider trailer insurance coverage to help protect the value of your trailer.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.